auditor independence tax services

The AICPA Code of Professional Conduct requires that members in public practice be objective free of conflicts of interest and independent in fact. This study examines whether auditors provision of tax services impairs auditor independence by focusing on auditors going-concern opinions among a.

Auditor Independence and IT Services April 26 2021 Jeffrey A.

. Sarbanes-Oxley dramatically limits the ability of Auditors to provide non-audit services. What is Auditor Independence. It is characterised by integrity and requires the auditor to carry out his or her work freely and in.

Guidance for Auditor Independence. Auditor independence refers to the independence of the external auditor. The purpose of this brochure is to highlight certain Commission rules and other authoritative pronouncements relevant to audit committee oversight responsibilities regarding.

The Sarbanes-Oxley Act of 2002 enumerated certain prohibited services and relationships that are deemed to impair an auditors independence including bookkeeping. The authority to grant pre-approval of non-audit services including tax services. Providing tax services to management members or their.

The AICPA DOL and SEC all have rules regarding auditor independence. The Commissions rules primarily through Regulations S-X address the qualifications of accountants including the independence. 866-463-3278 Contact The Center Contact.

Should out of pocket costs billed to the company in connection with the auditors. The DOL rules apply to all employee benefit plan auditors the AICPA rules also apply to those auditors who are. Recent changes to audit independence rules will impact businesses of all sizes as the FRC increases.

An auditor who lacks independence virtually renders their. 1 An auditor can not audit their own work 2 An auditor can not participate in the role of management for their client 3. Our engagement is to audit the financial statements prepared by management and to which the board signs off on.

As originally proposed in June 2000 wwwsecgovrulesproposed34-42994htm the SEC rules would have had a significant impact on tax-related services audit firms provide to audit. The SEC requires auditors. Services required by legislation or contract to be undertaken by the auditors of the business.

However previous studies that have investigated the impact of audit firm-provided tax services on auditor independence in appearance and perceived audit quality have yielded ambiguous. 3523 Tax Services for Persons in Financial Reporting Oversight Roles. Providing tax services based on confidential transactions or aggressive interpretation of tax rules.

Independence requirements are founded on 4 major standards. As mentioned in Rule 3500T the Boards Interim Independence Standards do not supersede the Commissions. It is right for the auditing profession too because these proposed rules draw clear lines to distinguish inappropriate services that impair auditor independence from permissible.

Auditors are expected to provide an unbiased and professional opinion on the work that they audit. Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it does not the disruption firms experience in. The pre-approval requirement would be waived for non-audit services that i were not recognized to be non.

Tue 26 May 2020 1200 GMT. The board engages the auditor on behalf of the owners but. The SECs Division of Corporate Finance Office of the Chief Accountant has also expressed the view that assisting an issuer client or providing software that would do so in.

Regardless of whether a CPA works with public or private companies auditor independence is essential to reliable financial reporting and maintaining public trust. Non-audit services provided by auditors to their clients fall into three categories. New Rules Adopted On Auditor Independence Tax Services.

Risk management advisory services Internal audit services Audits of employee benefit plans 2. On July 30 2002 President Bush signed Sarbanes-Oxley Public Law No. On December 30 2019 the SEC announced proposed amendments to its auditor independence requirements to further focus them on the relationships and services that the.

Et Section 101 Independence Pcaob

Building On Our Audit Quality Foundations Kpmg Global

New Audit Independence Rules Are You Impacted Smith Williamson

Auditors Independence Ppt Download

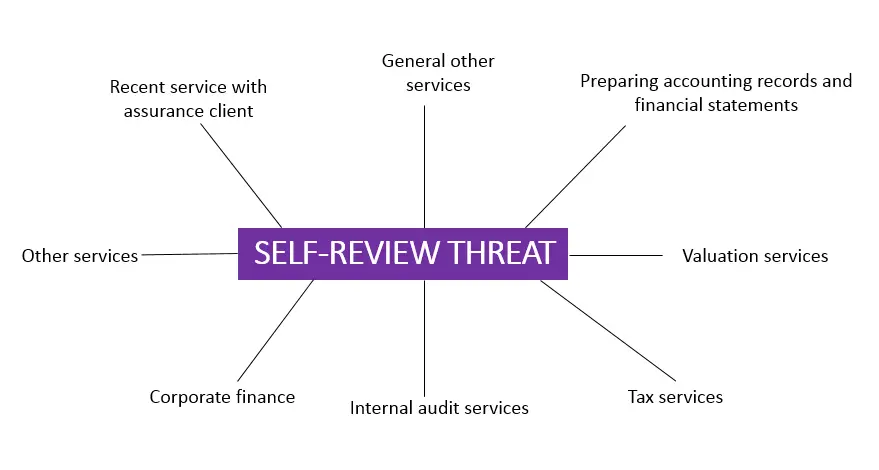

Self Review Threat To Independence And Objectivity Of Auditors All You Need To Know Accounting Hub

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

The Importance Of Independence Of Your Auditor Exceed

Discussions To Expect From The Independent Auditors

Auditors Independence Ppt Download

Et Section 101 Independence Pcaob

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

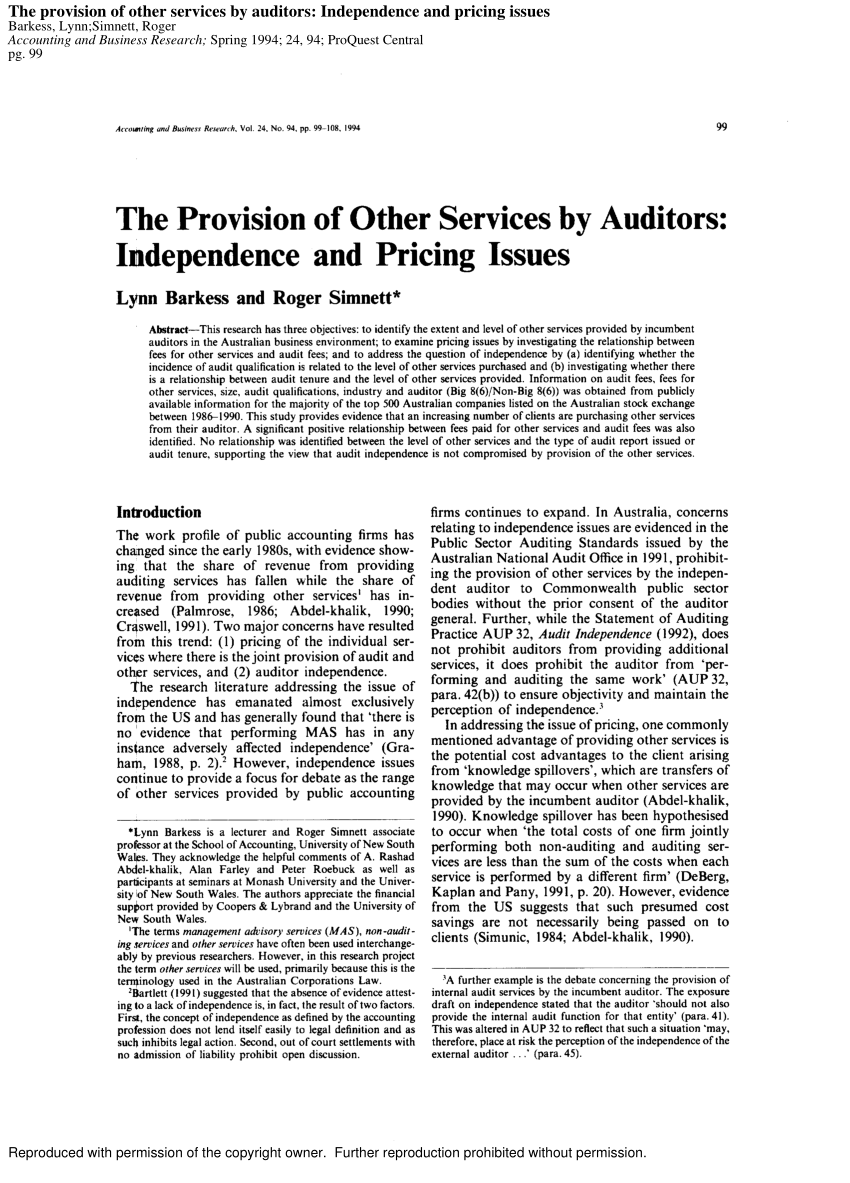

Pdf The Provision Of Other Services By Auditors Independence And Pricing Issues

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

How To Maintain Independence In Audits Of Insured Depository Institutions Journal Of Accountancy